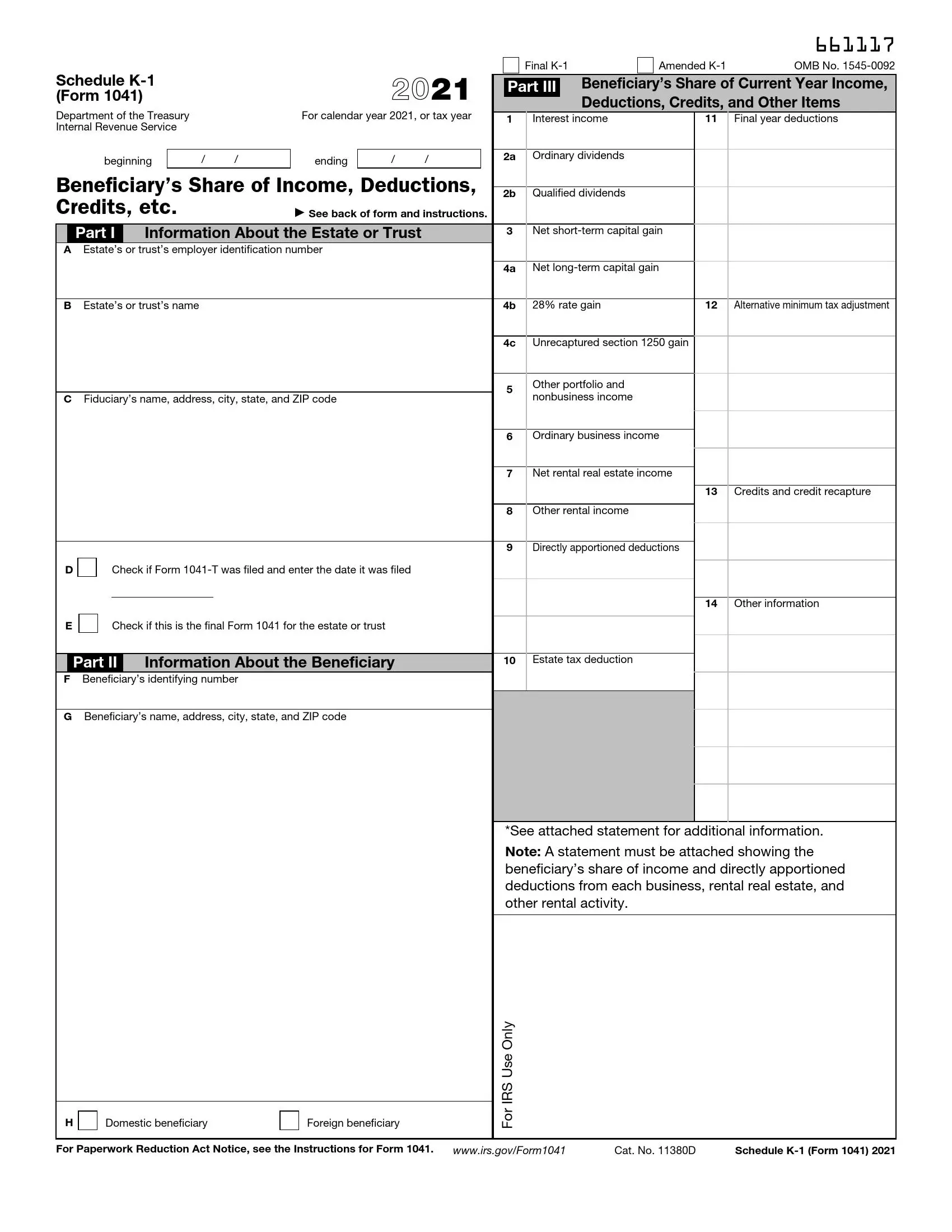

2024 Irs Form 1041 Schedule K-11 Instructions – Inheriting property or other assets typically involves filing the appropriate tax forms with the IRS. Schedule K-1 (Form 1041) is used to report a beneficiary’s share of an estate or trust . The return prescribed by the Secretary for the reporting of a trust’s taxable income is IRS Form 1041, and the Schedule K-1 is made a part of that return. The instructions promulgated by the IRS .

2024 Irs Form 1041 Schedule K-11 Instructions

Source : www.irs.gov3.11.14 Income Tax Returns for Estates and Trusts (Forms 1041

Source : www.irs.gov2023 Instructions for Form 1041 and Schedules A, B, G, J, and K 1

Source : www.irs.govIRS Schedule K 1 Form 1041 ≡ Fill Out Printable PDF Forms Online

Source : formspal.com3.11.14 Income Tax Returns for Estates and Trusts (Forms 1041

Source : www.irs.govWhat Is IRS Form 1041?

Source : www.thebalancemoney.com3.11.14 Income Tax Returns for Estates and Trusts (Forms 1041

Source : www.irs.gov2023 Instructions for Schedule I (Form 1041)

Source : www.irs.gov3.11.14 Income Tax Returns for Estates and Trusts (Forms 1041

Source : www.irs.gov10411204 Form 1041 U.S. Income Tax Return for Estates and Trusts

Source : www.nelcosolutions.com2024 Irs Form 1041 Schedule K-11 Instructions 2023 Instructions for Schedule K 1 (Form 1041) for a Beneficiary : The Internal Revenue Service (IRS) has announced updates to the Schedule 2 tax form and instructions for the upcoming tax years of 2023 and 2024. TRAVERSE CITY, MI, US, January 13, 2024 . Even though we’re well into February, it’s still possible that you might not have your W-2 yet. Here’s what to do. .

]]>

:max_bytes(150000):strip_icc()/Form1041-36b8feef0014418ab6aa150c951c7609.png)